Calendar Spread Using Calls – A so-called horizontal spread possible scenarios by using online profit/loss calculators. Likewise, while there’s no hard-and-fast “breakeven” on the long call calendar spread, you’ll need . Traders can use calls or puts and they can be set up to With Alphabet stock trading at $170, setting up a calendar spread at $175 gives the trade a neutral to slightly bullish outlook. .

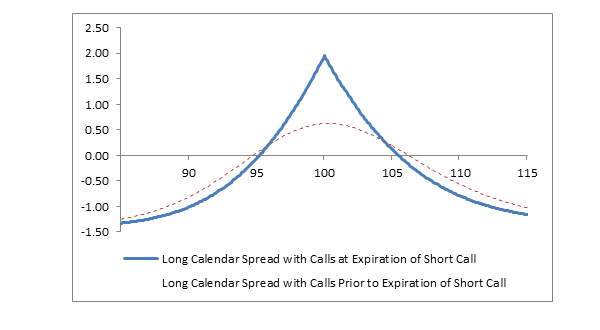

Calendar Spread Using Calls

Source : www.fidelity.com

The Poor Man’s Covered Call (and other Calendar Spreads) : r

Source : www.reddit.com

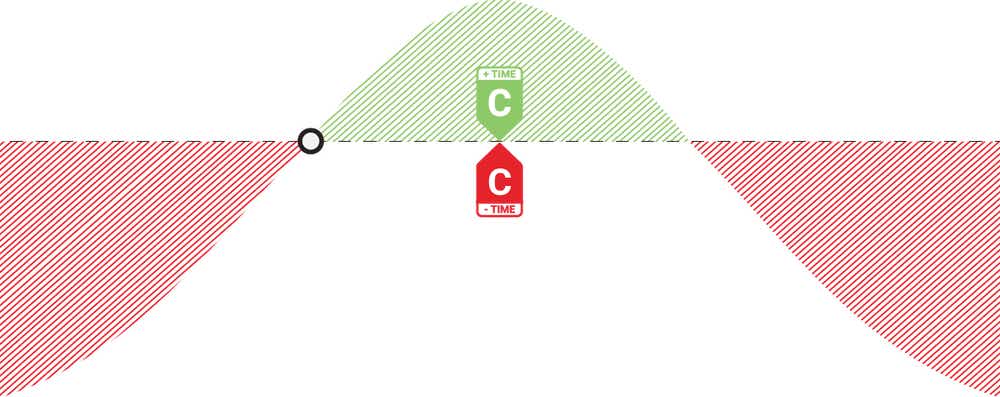

options Understanding the visual representation of a Calendar

Source : money.stackexchange.com

Call Calendar Spread Guide [Setup, Entry, Adjustments, Exit]

Source : optionalpha.com

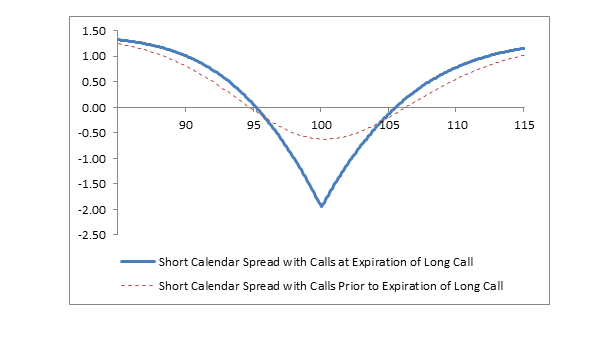

Short Calendar Spread with Calls Fidelity

Source : www.fidelity.com

Long Calendar Spreads for Beginner Options Traders projectfinance

Source : www.projectfinance.com

Calendar Spread Definition: Day Trading Terminology Warrior Trading

Source : www.warriortrading.com

Calendar Spread: What is a Calendar Spread Option? | tastylive

Source : www.tastylive.com

The Dual Calendar Spread (A Strategy for a Trading Range Market

Source : www.optionstrategist.com

Calendar Call: Definition, Purpose, Advantages, and Disadvantages

Source : www.strike.money

Calendar Spread Using Calls Long Calendar Spread with Calls Fidelity: A calendar spread, as the name suggests is a spread and is often simply called the underlying. Some of the most popular derivative contracts are forwards, futures, options, and swaps. . Calendar spread indicate what is the gap in prices of two different expiry contracts of a particular commodity. This shows whether that commodity is moving in contango or backwardati .